Handling taxes is an unavoidable part of running a business. You want your business to comply with the law and have your finances in order. Being accurate and efficient with your taxes benefits all aspects of your business, so to make this process easier you can handle it directly on your CRM.

Tax Settings allows you to add, manage, and apply taxes effectively. This powerful tool saves time, reduces mistakes, and smooths financial operations.

Tax Settings in Subaccounts.

You can manage your taxes by adding them to products or invoices directly, keeping a record to follow with every sale. How to add them depends on the type of Tax you need to add, but to start go to the Settings tab inside the Payments section and select the Taxes option to your left.

The process will vary depending on whether you're set manual or automatic taxes (only available in the US).

Managing Taxes

Including Tax in Prices

In your CRM's tax settings, you have the option to define whether product prices should include tax by default:

Clicking on YES includes tax in the listed purchase price, so the customer sees the full amount, including tax, upfront, while choosing NO excludes tax from the displayed price. The tax is added only at checkout, showing customers the price without tax initially.

Choosing the right option depends on whether you want customers to see the total price (with tax) immediately or only at checkout.

Adding Tax

By clicking the +Add Tax button you can create a new tax that applies to the product you are selling.

To do so, follow these steps:

- Set the name of the tax for easy identification in the system.

- Add a percentual rate for your tax. For example 5% or 12%.

- Enter a short description as needed, this will be shown to customers.

- Enter the Tax ID and Agency information, this will serve your internal purposes.

Deleting Tax

You can delete a tax by clicking the waste bin icon on the right of the tax you want to delete.

Taxes for Software as a Service

In addition to Tax Settings, if you're a SaaS company operating in places like the EU, UK, or North America, we have a workaround using Stripe tax management.

This temporary solution helps you manage taxes better and comply with regional tax rules. It also improves the experience for your customers when they make payments for your services. Here's how to set it up:

Tax Rates in Stripe

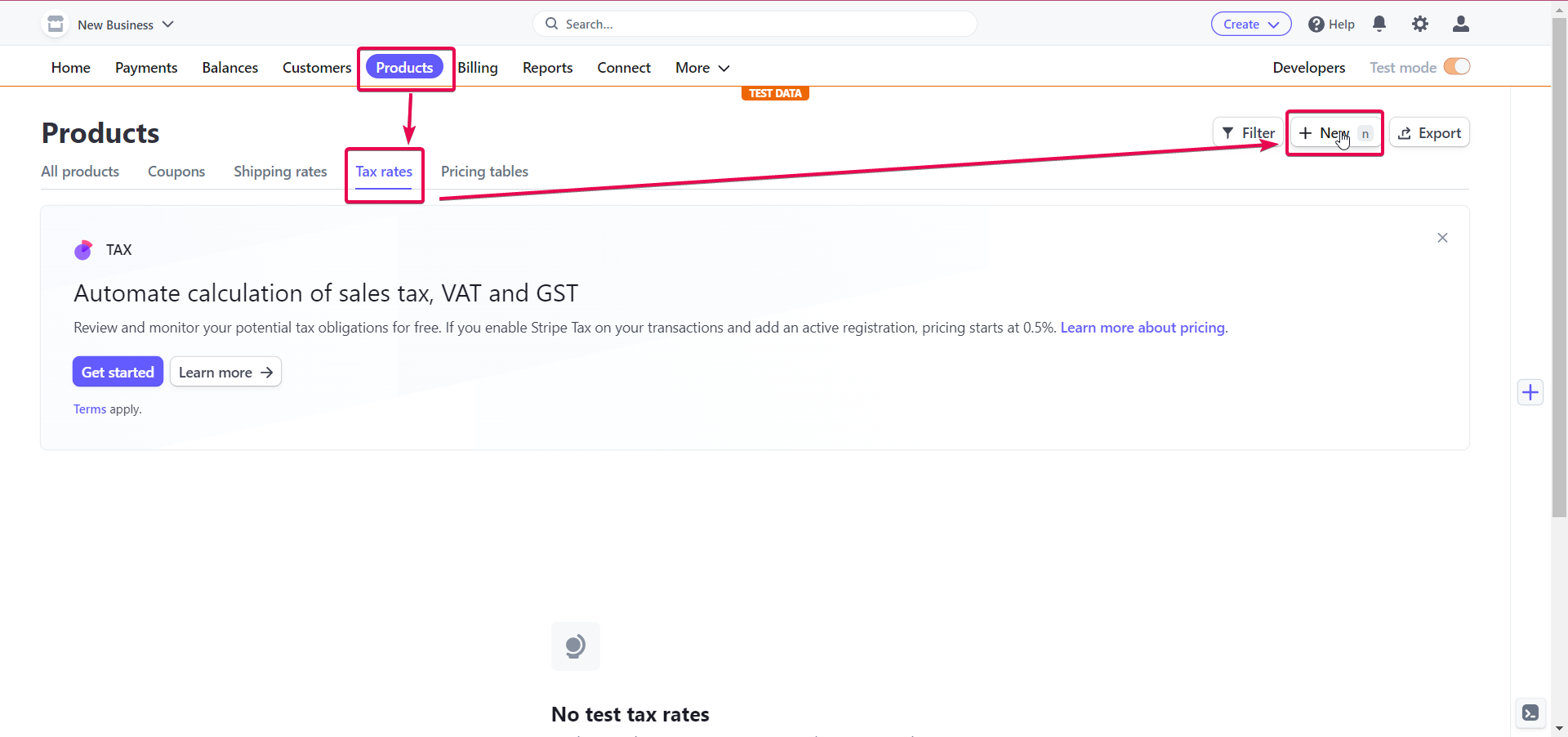

Log in to your Stripe account. And go to the “Products” section and select "Tax Rates" then click "New."

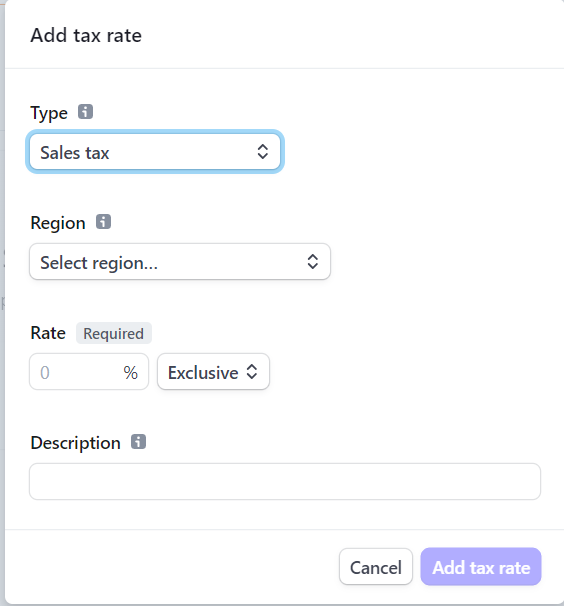

Fill in details like the tax name, the percentage rate, and whether it's included in the price or added on top of it. Click "Add Tax Rate" to create the tax rate.

Applying Tax Rates to Customers

- In Stripe, go to "Customers."

- Select the customer whose subscription you want to change.

- Click "Edit subscription."

- Under "Add Tax," choose the tax rate you created earlier.

- Save your changes to apply the tax rate to the customer's subscription.

Adding Tax Rates for New Customers

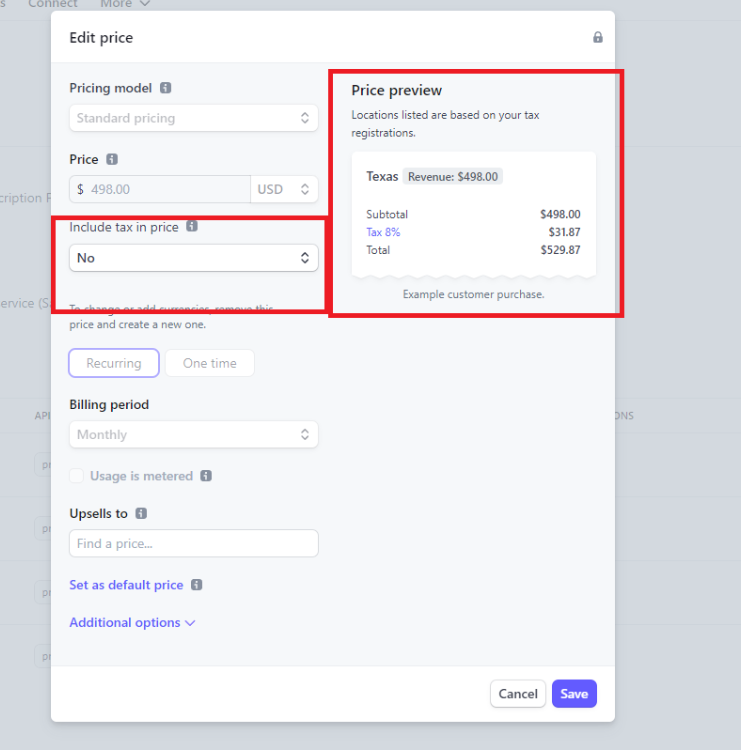

Once you've set up Stripe's Tax management service, you can select tax categories for your SaaS products.

Select whether to include the tax and check the price preview to finalize the set up.

Sharing Your SaaS Link

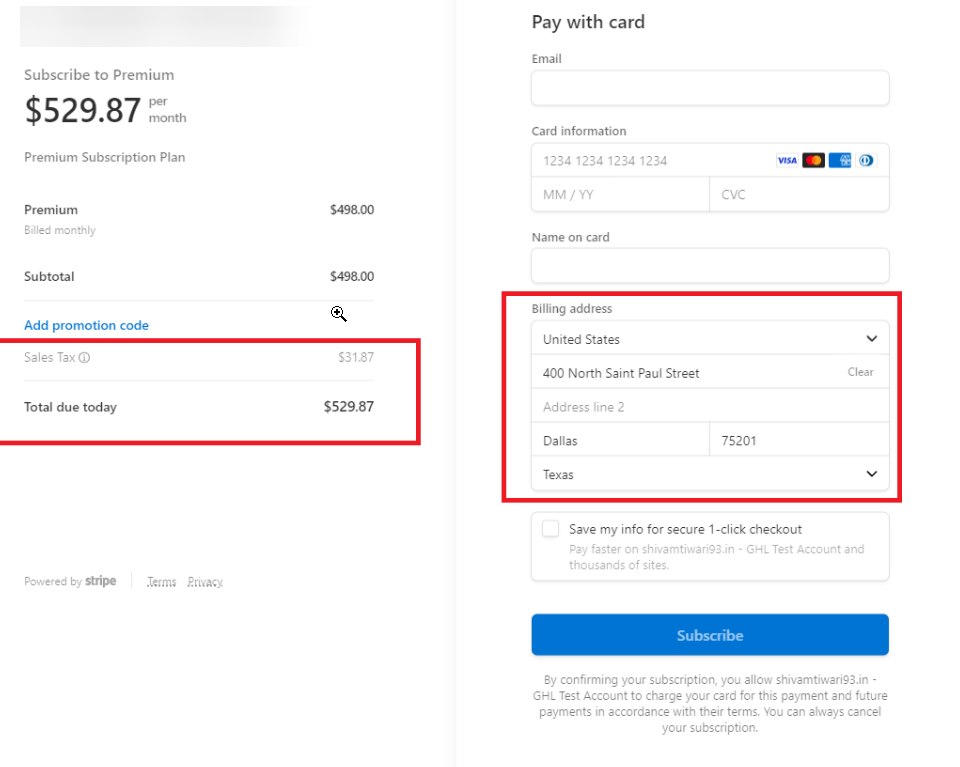

Follow the instructions to add your created tax rate to your SaaS product payment link. You may also need to decide whether to include taxes in your prices or charge them separately for each product.

Copy the SaaS payment link and share it with your customers. When a customer goes to the payment page they will see the payment including the sales tax.

Important Note

This Stripe tax management method is only available for SaaS direct payment links and not for funnel sales. It's a temporary solution until a more comprehensive tax management system is developed.

By following these steps, you can efficiently manage taxes for your business and make sure you're following the rules in your region. It's like having a helpful tool that simplifies things and keeps your financial operations running smoothly.

FAQs

Q: How do I handle tax exemptions for specific customers using the CRM Tax Settings feature or the SaaS workaround?

- A: For the CRM Tax Settings feature, create a tax with a 0% rate and apply it to the exempt customer's invoice. For the SaaS workaround, create a custom tax rate with a 0% rate in Stripe and apply it to the exempt customer's subscription.

Q: Can I use multiple tax rates with the CRM Tax Settings feature and the SaaS workaround?

- A: Both methods allow you to create and apply multiple tax rates for different products, services, or customer locations. You can add various taxes to an invoice in the CRM Tax Settings feature. In the SaaS workaround, you can select the appropriate tax rate when editing a customer's subscription in Stripe or configure your third-party Stripe integration to apply the correct tax rate during checkout.

Q: What happens if a customer changes their location or billing address?

- A: You must update the customer's tax rate based on their new address for both methods. In the CRM Tax Settings feature, update the taxes on their invoice. For the SaaS workaround, update their subscription in Stripe and configure your third-party Stripe integration to automatically update tax rates during checkout.

Q: Can I apply taxes to one-time purchases using both methods?

- A: By adding taxes to an invoice, you can apply taxes to one-time purchases using the CRM Tax Settings feature. With the SaaS workaround, create tax rates in Stripe and use a third-party integration that supports dynamic tax calculation during checkout.

Q: How do both methods handle refunds?

- A: For the CRM Tax Settings feature, adjust the tax amounts manually on the refunded invoice. With the SaaS workaround, Stripe will automatically calculate and refund the correct amount of taxes based on the original transaction.

Q: Can I generate tax reports using both methods?

- A: The CRM Tax Settings feature does not directly provide tax reports, but you can export invoice data, including tax information, and use third-party tools or accounting software to generate tax reports. For the SaaS workaround, export transaction data from Stripe and use similar tools or software to create tax reports.

Q: How do I handle tax changes or updates using both methods?

-

A: For the CRM Tax Settings feature, update the tax rates in your tax list and apply the updated rates to new invoices. For the SaaS workaround, revise the tax rates in Stripe and edit existing customer subscriptions to apply the updated rates. You may also need to update your third-party Stripe integration settings to ensure accurate tax calculations during the checkout process.